(104) New Tips & Hints

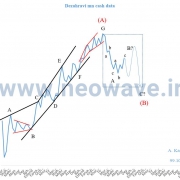

We all know Wave Theory is best suited for stock averages and non-consumable items, not individual companies. Using only price data to count waves, how can one pick the best stocks?

ANSWER:

This is a great question and one many of you have had to grappled with, I’m sure. Personally, I never attempt wave counts on individual companies, but I do regularly follow stock averages, such as the S&P 500 (which works great). If I managed a fund and wanted to use wave theory as a basis for choosing and trading stocks, this is how I’d go about it.

First and foremost, using a major stock average (i.e., the S&P 500, the Nasdaq, Russell 5000, etc.), I would determine whether the primary trend is up or down. From there, I would break that particular stock average into its component parts or sectors (industrials, technology, retail, financials, etc.). I’d then construct wave counts on each sector to see how its trend agreed with the larger average. Of all the sectors analyzed, I’d choose the TOP 3-5 that most agreed with the larger average’s trend or that appeared the strongest. Then I would pick the 3-5 largest stocks in that sector and invest in them.

I would not attempt analysis on individual stocks. Not only do I think it is unnecessary and time-consuming, but probably not productive. Sectors and averages work much better, as Francisco indicates in his question.

9 دی 99

9 دی 99

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.