(54) New Tips & Hints

How do you know when a wave pattern ends after a high or after a low?

ANSWER:

This is an extremely important question that must be understood if your goal is accurate NEoWave labeling and forecasting. It is an unfortunate fact that most wave practioners, especially those practicing orthodox Elliott Wave, begin and end nearly every wave pattern at a market top or bottom. This may come as a surprise, but in reality, at least 50% of all market moves end below a high, above a low, before a high or before a low.

Why is this the case? Remember, wave theory measures market psychology, not financial impact. The greatest financial impact occurs at top and bottom tick of a market advance or decline, but that does not mean its emotional impact is simultaneously achieved. For example, the price peak of the bull market occurred in March 2000, but the psychological “breaking point” of the advance occurred six months later in September. That is the reason the S&P meandered so long before beginning a clear downtrend. The bear market’s price low was October 2002, but the psychological conclusion of that decline was March 2003. If you had sold top tick in 2000 or bought bottom tick in 2002, in both cases (on a monthly chart) you would have waited many months before volatility died and a clear trend emerged.

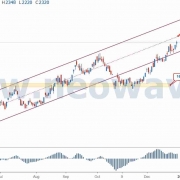

How do you distinguish between a market top or bottom and the actual end of a trend? The primary determining factor is price behavior. This is where NEoWave concepts are extremely useful and is the reason NEoWave forecasts are more accurate than orthodox Elliott Wave forecasts. If a market has been advancing for an extended period (like the run-up to 2000’s high), the start of a new “bear phase” MUST (according to NEoWave theory) produce a move larger and faster than any prior corrective decline during the “bull phase” (I have placed both conditions in quotes to emphasize bull and bear are relative concepts). If such an event does not occur following the highest high, then the uptrend is not over or the pattern will conclude later at a lower high. On the other hand, if a market has been declining for an extended period (“extended” is a relative concept based on the number of bars or waves present on the chart being analyzed), the new “bull phase” MUST produce an advance larger and faster than any corrective rally during the prior “bear phase.” If the advance off the lowest low is slower or smaller than prior corrective rallies, that low is NOT the end of the “bear phase,” which means the decline is either not over or the “bear phase” will end at a higher low in the future.

The NEoWave concept of “post-pattern” confirmation is unique, scientific and logical and must be applied if you desire accurate wave labeling. Only once your wave labels are correct can you then expect reliable forecasts.

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.