(New Tips & Hints (17

What`s the proof that a pattern ended at a certain point and at what time is NEoWave able to predict this?

ANSWER:

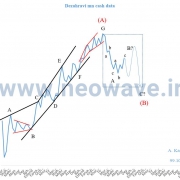

This two part question was raised by long-time subscriber Manfred Koeller of Hessen Germany. In Chapter 6 of Mastering Elliott Wave (MEW) I address the two stages of pattern confirmation, which answers the first part of his question. To elaborate, before the process of confirmation can be addressed, it is essential the formation you are attempting to confirm obeys all NEoWave and Elliott Wave rules. If that is the case, and you think an impulsion has ended, Stage 1 confirmation must be present, which occurs when the 2-4 trendline is violated in less time than wave-5 took to form. Stage 2 confirmation exists when wave-5 is completely retraced in less time than it took to form. If both stages of confirmation are met, and all wave development rules for an impulsion are present, then NEoWave theory has given you the “proof” you seek that your impulsive interpretation is correct. If the first stage of confirmation is met, but not the second, the impulsion is in question and must be confirmed by future price behavior.

Regarding the second part of your question, NEoWave theory creates the first, logical structure to market analysis, where the analyst does not “predict,” but rather observes and confirms, behavior events. As such, NEoWave is not able to predict (i.e., before the evidence is present) the confirmation or conclusion of a pattern, it can only confirm it shortly after the fact.

9 دی 99

9 دی 99

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.