(New Tips & Hints (25

How do I know when a pattern starts higher than the low or lower than the high?

ANSWER:

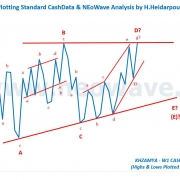

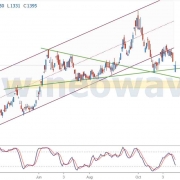

A common mistake made by wave practitioners is that of starting wave counts from the lowest low or highest high of a market advance or decline (respectively). Probably due to the fact price lows and highs are easy to identify, most simply assume wave counts begin there. Even though the greatest financial reward or damage does occur at price extremes, Wave theory is the quantification and structuralization of mass psychology. Unfortunately, periods of pessimism and euphoria rarely conveniently peak at price tops and bottoms.

To make sure you are beginning your counts at the correct starting points, it is important you observe the behavior of price action near highs and lows. If the initial rally (off a major low) or decline (off a major high) is retraced more than 61.8%, it is nearly certain the new opposing trend will begin after that major low or high. In starting a new trend, it is nearly always required (except following an Expanding Triangle) that the new trend move further and faster than any previous correction of the previous trend. For example, if the S&P is topping and the first decline off the high is retraced 80%, you know the conclusion of the advancing wave structure is not over. As long as a new high is not made, the last label of the advance (probably wave-5 or maybe wave-c) will be placed to the right of the highest high. When the psychology has run its course and the uptrend is over, a decline larger and faster than any corrective decline during the advance must occur to start the new downtrend.

دیدگاه خود را ثبت کنید

تمایل دارید در گفتگوها شرکت کنید؟در گفتگو ها شرکت کنید.